Understanding Notary Bonds

To fully grasp the significance of the California Notary Bond, it is important to understand what a notary bond is and its purpose within the notary public system.

What is a Notary Bond?

A notary bond is a type of insurance that serves as a financial guarantee for the notary public's actions and responsibilities. It is a legal requirement in many states, including California, for individuals serving as notaries. The bond provides protection to the public in the event of any negligence or misconduct by the notary during their official duties.

In simple terms, a notary bond is a form of consumer protection. It ensures that if a notary fails to fulfill their obligations or causes harm to a client due to their actions, the affected party can seek compensation from the bond. This compensation helps to safeguard the public's interests and provides a sense of security when engaging with notary services.

The Purpose of a Notary Bond

The primary purpose of a notary bond is to protect the public from financial loss or harm resulting from a notary's improper actions. By requiring notaries to have a bond, the state ensures that individuals holding this esteemed position are held accountable for their actions and adhere to the highest ethical standards.

A notary bond also serves as a means of promoting confidence in the notary public system. It provides assurance to clients that the notary is financially responsible and committed to upholding their duties. The bond acts as a safeguard against fraudulent or negligent activities that could otherwise undermine the integrity of the notary profession.

In the case of California, notaries are required to obtain a California Notary Bond as part of their compliance with the state's notary regulations. This bond is essential for individuals seeking to become notaries in California and is a fundamental component of the notary public application process. For more information on the requirements to become a notary in California, refer to our article on California Notary Requirements.

Understanding the purpose and significance of the notary bond is crucial for notaries operating within California. It ensures that they comprehend the importance of their responsibilities and the role the bond plays in protecting the public's interests. By maintaining the bond and upholding their obligations, notaries contribute to the legitimacy and integrity of the notary public system in California.

California Notary Bond

In California, notaries play a vital role in various legal and business transactions. To ensure their credibility and safeguard the public's interests, California notaries are required to obtain a California Notary Bond. This section will explore the requirements for California notaries and the role that the California Notary Bond plays in their profession.

Requirements for California Notaries

Becoming a notary in California involves meeting specific requirements outlined by the state. To qualify as a notary, individuals must:

- Be at least 18 years old.

- Reside or work in California.

- Be a legal resident of the United States.

- Complete a notary education course approved by the California Secretary of State.

- Pass a written examination administered by the Secretary of State.

- Complete and submit a notary public application to the Secretary of State along with the required fee.

For more detailed information about the requirements for becoming a notary in California, refer to the California Notary Handbook.

The Role of the California Notary Bond

The California Notary Bond is a crucial component of a notary's professional responsibilities. It serves as a form of insurance that protects the public from financial harm caused by a notary's negligence or misconduct. By obtaining a notary bond, notaries demonstrate their commitment to upholding ethical standards and fulfilling their duties with integrity.

The California Notary Bond acts as a guarantee of the notary's compliance with state laws and regulations. It provides a financial resource for individuals who suffer losses due to a notary's wrongful acts or omissions. The bond ensures that claimants have a means of seeking compensation if they encounter any issues related to a notarized document or transaction.

In the event that a valid claim is made against a notary's bond, the surety bond provider will investigate the claim and, if necessary, provide financial reimbursement to the claimant up to the bond's coverage amount.

By requiring notaries to obtain a bond, California reinforces the importance of accountability and professionalism within the notary public profession.

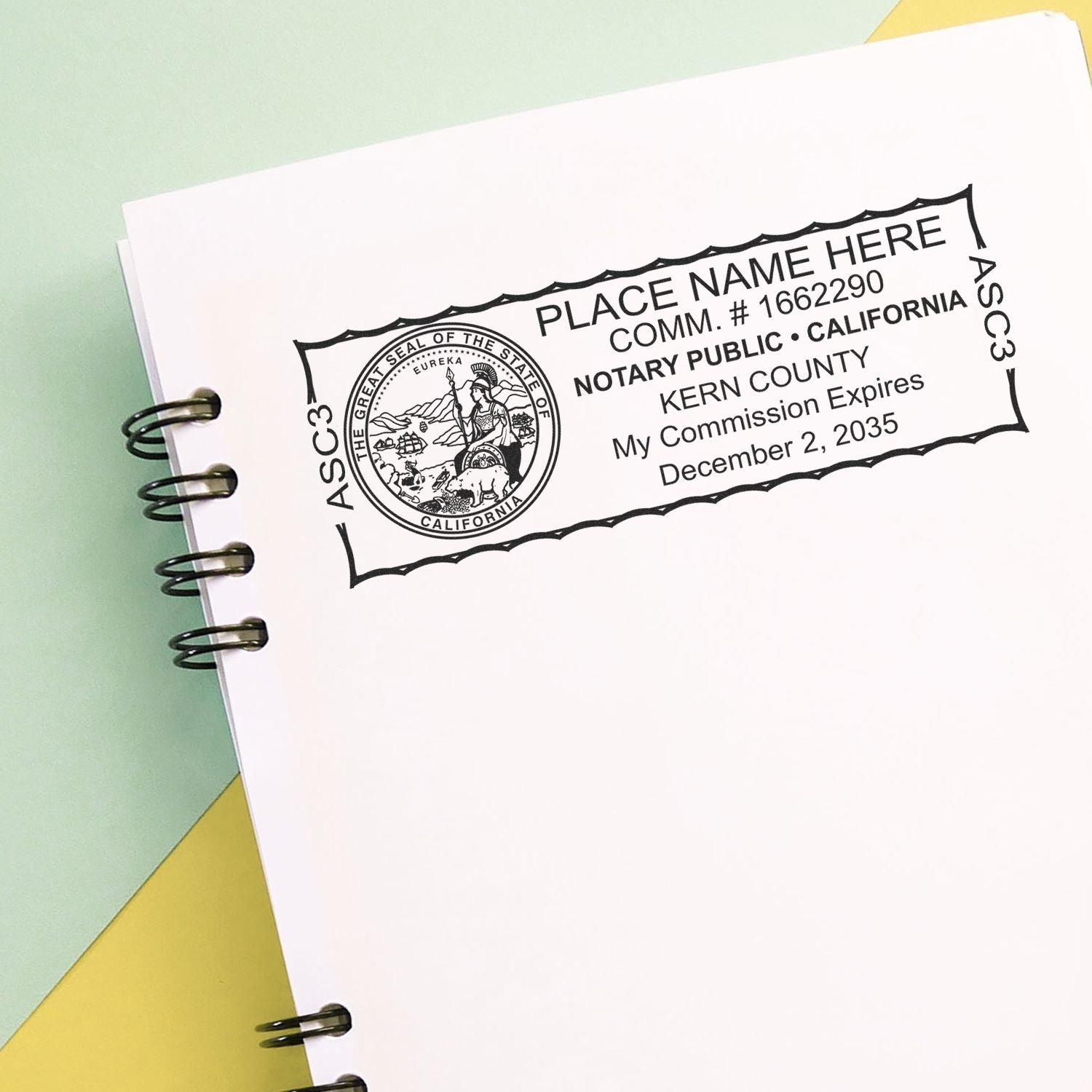

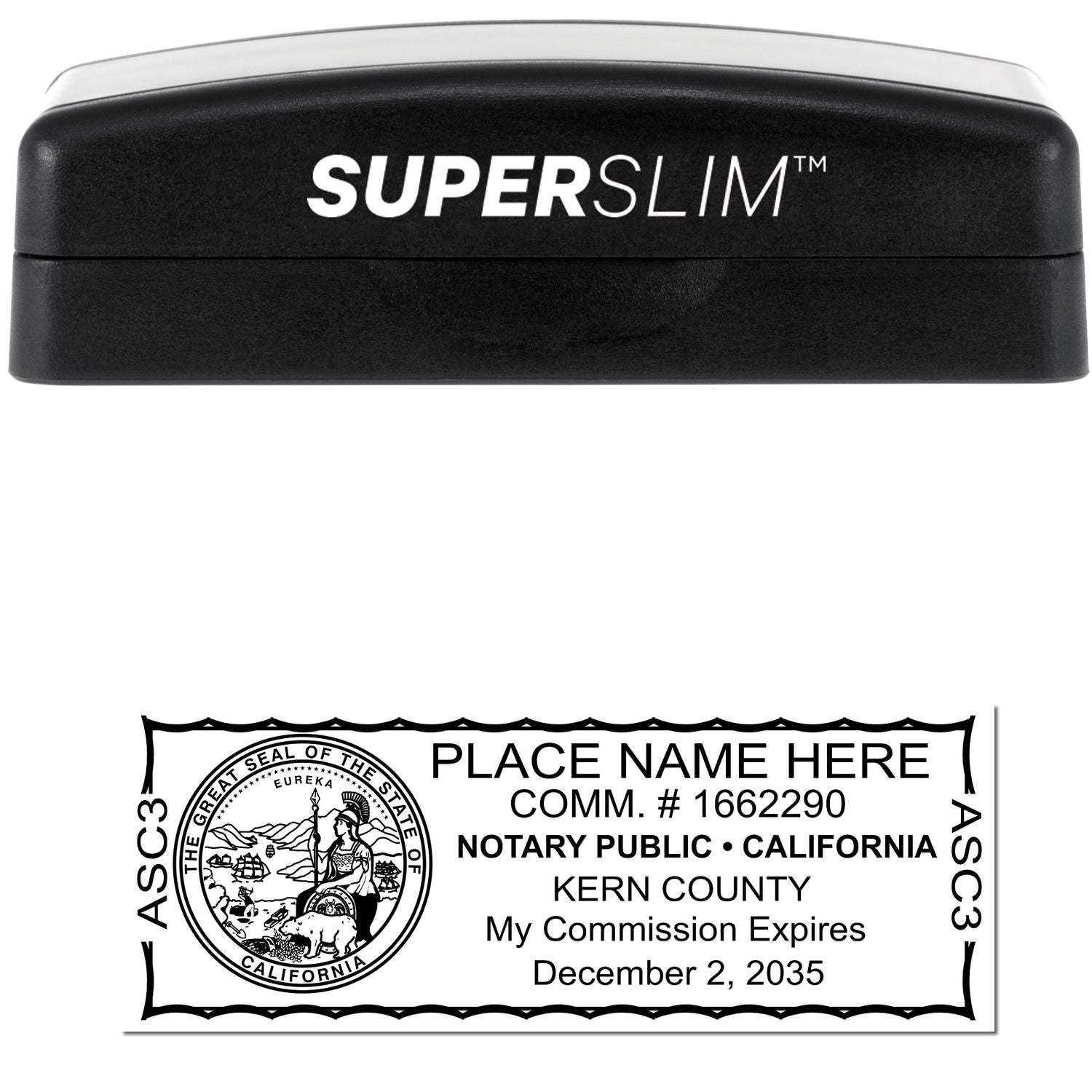

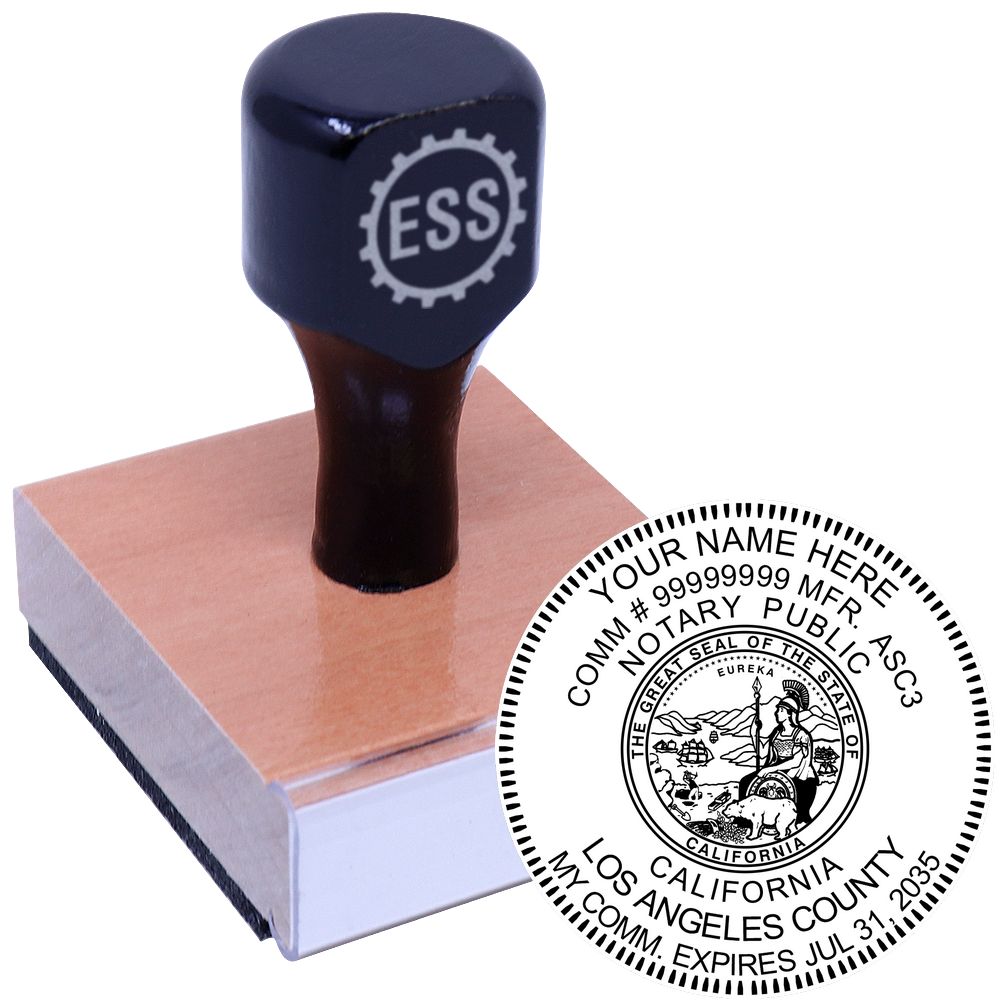

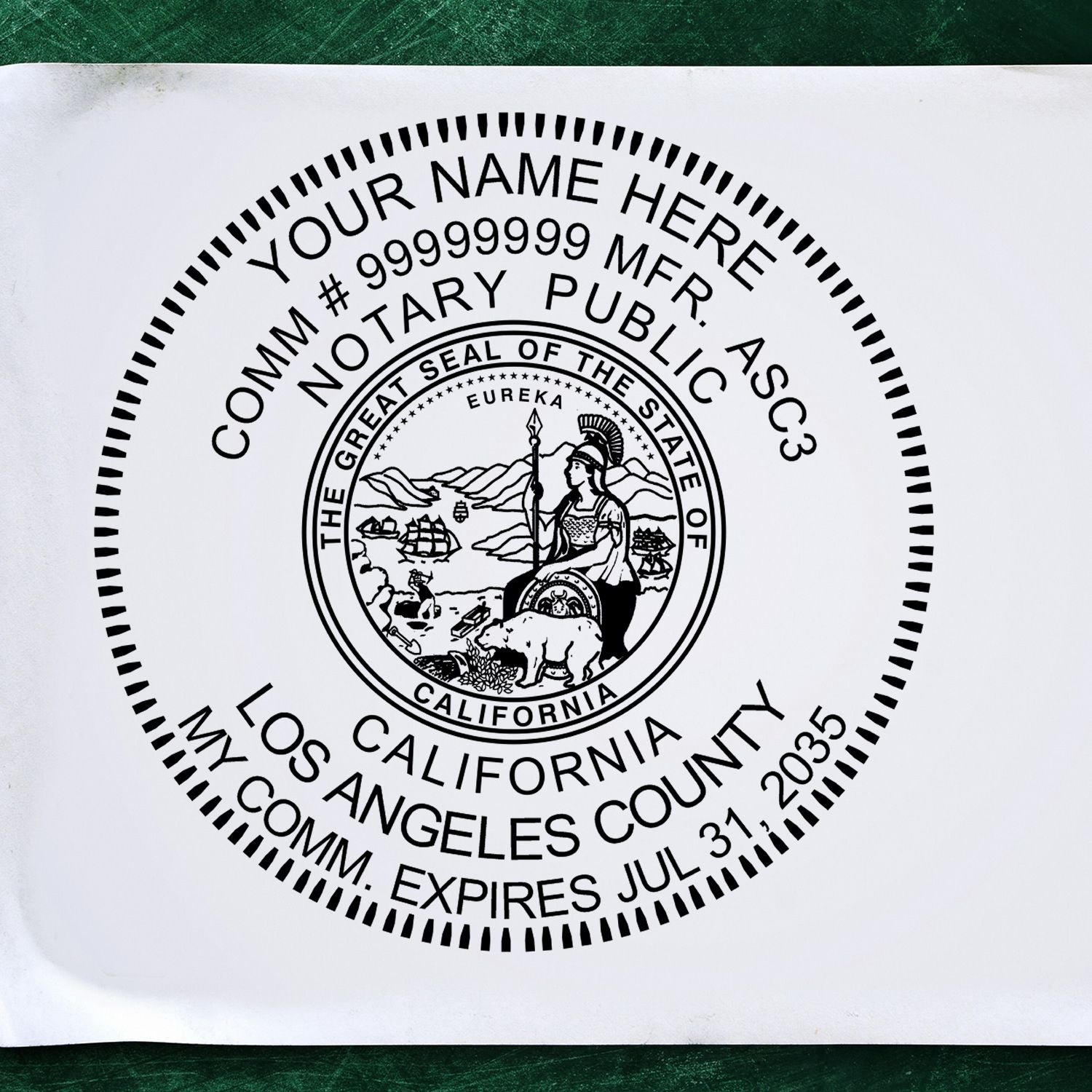

Understanding the requirements for becoming a notary in California and the role of the California Notary Bond is essential for individuals considering embarking on this career path. It is crucial to meet all the necessary qualifications and obligations to ensure the integrity of the notarial process and protect the public's interests. For more information on California notary stamps and supplies, refer to our article on California Notary Stamp.

Benefits of the California Notary Bond

The California Notary Bond offers several key benefits to both notaries and the public they serve. Let's explore two significant advantages: protecting the public and ensuring notary accountability.

Protecting the Public

One of the primary purposes of the California Notary Bond is to protect the public from any potential misconduct or negligence by notaries. The bond serves as a form of financial security that guarantees compensation to individuals who suffer financial harm due to a notary's wrongful actions. This ensures that individuals who rely on notarized documents can have confidence in their validity and legal standing.

In the event that a notary acts inappropriately or fails to fulfill their duties, the affected parties can file a claim against the bond. This provides a safety net for individuals who may otherwise face financial losses or legal complications due to the notary's actions. By holding notaries accountable and providing compensation for damages, the bond helps maintain the integrity of notarized documents and promotes trust in the notarial system.

Ensuring Notary Accountability

The California Notary Bond also plays a crucial role in ensuring notary accountability. Notaries in California are required to obtain a bond as part of their licensing process. This requirement encourages notaries to adhere to their professional and ethical responsibilities, knowing that any misconduct may result in financial repercussions.

By having a financial stake in their actions, notaries are more likely to act with the utmost care and diligence when performing their notarial duties. They are motivated to follow proper procedures, verify identities, and accurately document transactions. This accountability helps protect against fraud, forgery, and other unethical practices that could undermine the integrity of notarial acts.

The California Notary Bond, therefore, serves as a powerful tool in maintaining the professionalism and credibility of notaries. It reinforces the importance of ethical conduct and instills confidence in the public that notaries are reliable and trustworthy.

Understanding the benefits of the California Notary Bond is essential for both notaries and those who rely on notarial services. By upholding the highest standards of professionalism and accountability, notaries can fulfill their vital roles in society, and the public can have peace of mind when relying on notarized documents.

Obtaining a California Notary Bond

To become a notary public in California, one of the essential requirements is obtaining a California notary bond. This bond serves as a form of insurance that provides protection to the public and ensures the accountability of the notary. Let's explore the steps involved in obtaining a California notary bond.

Finding a Surety Bond Provider

To obtain a California notary bond, you will need to find a reputable surety bond provider. Surety bond providers specialize in issuing bonds to individuals in various professions, including notaries. It is important to choose a reliable provider that offers competitive rates and excellent customer service.

When searching for a surety bond provider, consider factors such as their experience in the industry, their reputation, and the ease of the application process. You may also want to explore whether the provider offers any additional services or resources that may be beneficial to you as a notary. For more information on becoming a notary in California, you can refer to the California Notary Handbook.

Application Process and Fees

Once you have selected a surety bond provider, you will need to go through the application process. The application typically involves providing personal information, such as your name, address, and contact details. You may also be required to provide documentation related to your notary commission or other credentials.

During the application process, you will also need to pay a fee to obtain the California notary bond. The fee amount can vary depending on the surety bond provider and the coverage amount required. It is important to review the terms and conditions of the bond and understand the fee structure before proceeding with the application.

After completing the application and paying the required fee, the surety bond provider will issue the California notary bond. This bond serves as a guarantee to the state of California that you, as a notary public, will fulfill your duties responsibly and ethically. It provides peace of mind to the public, assuring them that their transactions and legal documents are in safe hands.

By following these steps and obtaining a California notary bond, you can fulfill one of the necessary requirements to become a notary public in California. Remember to explore other important requirements and resources, such as the California notary stamp and notary public application in California, to ensure a smooth and successful journey in your notarial career.

Maintaining the California Notary Bond

Once you have obtained your California Notary Bond, it is essential to understand the process of maintaining it to ensure continuous compliance with the state's requirements.

Renewal Process

The California Notary Bond has a validity period of four years. To maintain an active bond, notaries must renew their bond before it expires. The renewal process involves the following steps:

-

Review the renewal requirements: It is crucial to familiarize yourself with the specific renewal requirements outlined by the California Secretary of State. These requirements may include completing a renewal application, paying the necessary fees, and submitting any additional documentation if required.

-

Complete the renewal application: The renewal application can typically be completed online through the California Secretary of State's website. Ensure that you provide accurate and up-to-date information as required.

-

Pay the renewal fee: There is a renewal fee associated with the California Notary Bond. The fee amount may vary, so it is advisable to check the current fee schedule provided by the California Secretary of State.

-

Submit the renewal application: Once you have completed the renewal application and paid the fee, submit the application through the designated online portal or by mail, following the instructions provided by the California Secretary of State.

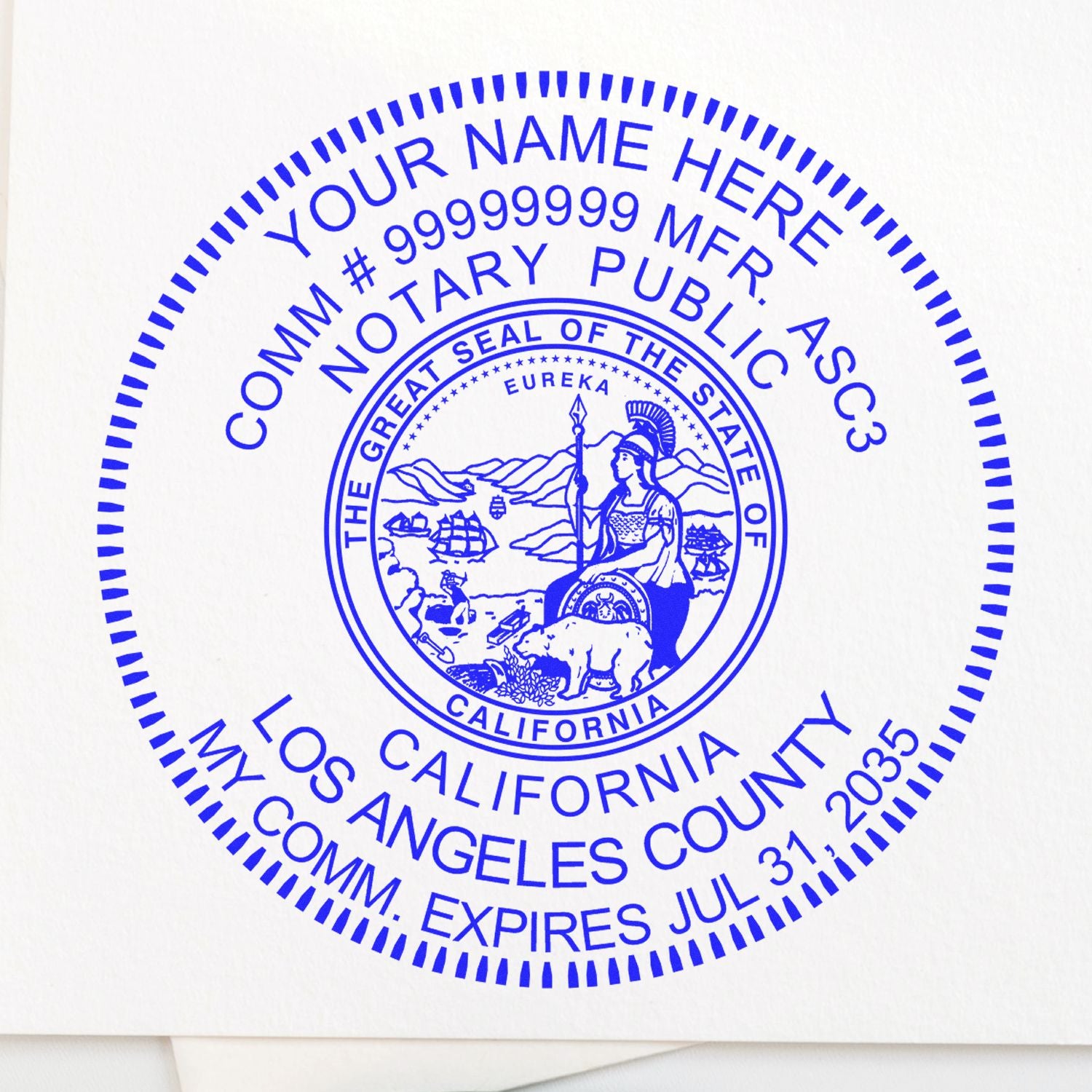

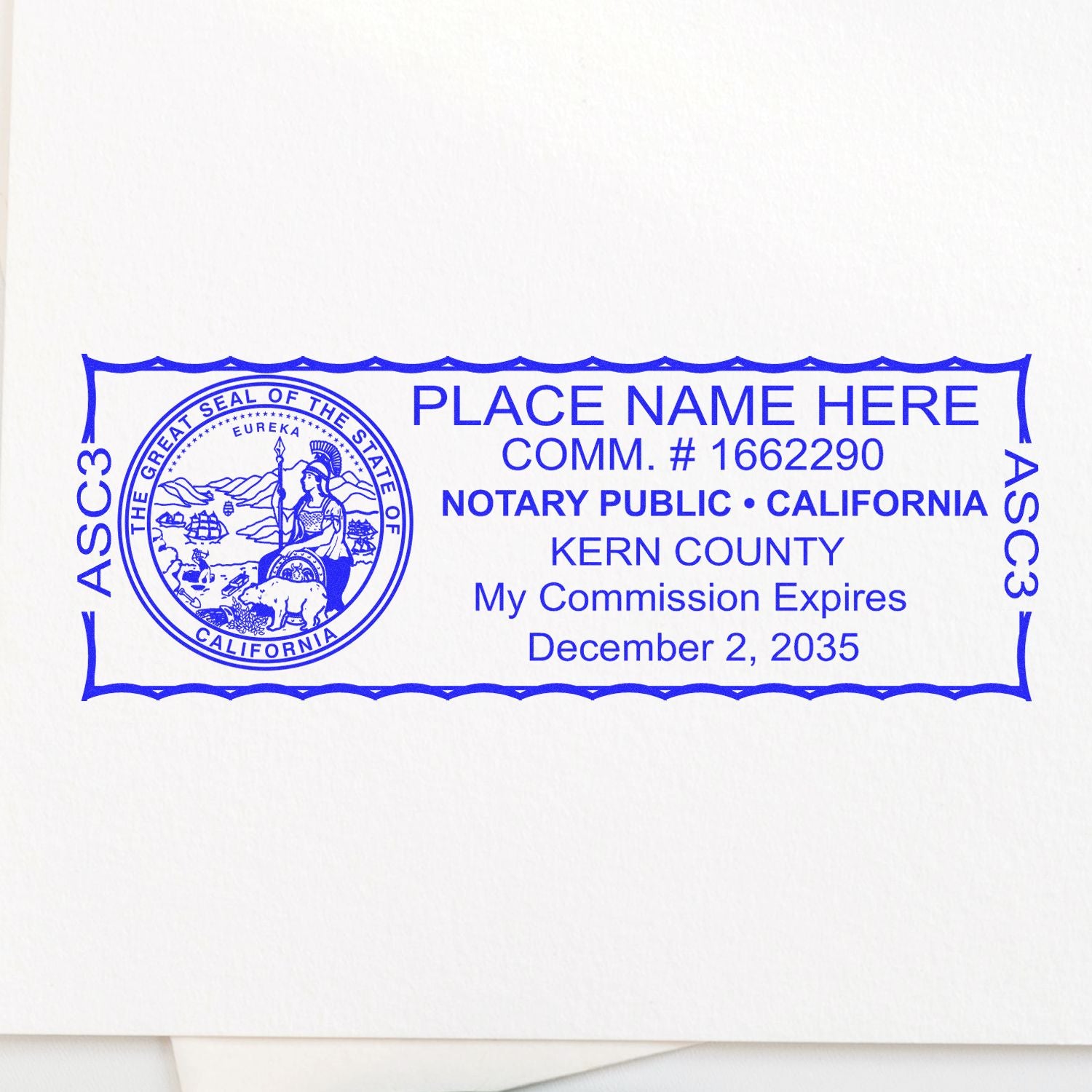

Save 14%

Premium Pre-Inked California MaxLight Notary Public Stamp1011MAX-CASale price$42.95 Regular price$49.95

Premium Pre-Inked California MaxLight Notary Public Stamp1011MAX-CASale price$42.95 Regular price$49.95 -

Await confirmation: After submitting your renewal application, you will receive confirmation once your bond has been renewed. This confirmation will serve as proof of your active bond status.

Potential Consequences of Bond Lapses

Failing to renew your California Notary Bond before it expires can have various consequences. Here are some potential repercussions of bond lapses:

-

Inability to perform notarial acts: Notaries with expired bonds are not authorized to perform any notarial acts until their bond is renewed. This includes notarizing documents, administering oaths, and taking acknowledgments.

-

Liability concerns: In the event of a bond lapse, notaries may be held personally liable for any damages or losses incurred by a party relying on a notarized document during the period of the bond lapse.

-

Administrative penalties: The California Secretary of State may impose administrative penalties for failing to maintain an active bond. These penalties can include fines or other disciplinary actions.

To avoid the potential consequences of bond lapses, it is crucial to stay aware of your bond's expiration date and initiate the renewal process in a timely manner.

Remember, maintaining an active California Notary Bond is just one aspect of being a responsible and accountable notary public. Familiarize yourself with the California Notary Handbook and ensure you meet all other California notary requirements to perform your notarial duties effectively.

About ESS

Engineer Seal Stamps, also known as ESS, is a leading provider of high-quality custom rubber stamps, professional seals, and notary stamps. With a commitment to excellence in both product and service, we take great pride in offering a state board guarantee on all of our products. Our top-of-the-line engineer seal stamps and professional seals are perfect for architects, engineers, and anyone else in need of reliable and accurate stamping solutions.

At ESS, we understand that time is valuable. That's why we offer a quick turnaround on all of our products, ensuring that you receive your order in a timely and efficient manner. We believe that customer satisfaction is the foundation of any successful business, which is why we strive to provide stellar customer service to all of our clients. From the moment you place your order, our knowledgeable and friendly staff will work closely with you to ensure that your needs are met in every way possible.

In addition to our commitment to quality products and exceptional customer service, ESS also strives to be an environmentally conscious company. We make every effort to reduce our environmental impact by using sustainable and eco-friendly materials in our stamp production process. At ESS, we are dedicated to providing our customers with the highest quality stamping solutions. With our commitment to excellence, state board guarantee, quick turnaround, and environmentally conscious practices, you can trust that you are receiving the best products and service available.